Table of Contents

Gap Trading: What is a gap trading?

When any index or a stock in share market on previous day is closed very high or very low compared to today’s opening time, the incident is called a gap down or a gap up opening. There might be a plenty of reasons behind the same like war situation, any sudden policy change, any quarterly profit report or sudden loss of any company etc.

Gap Trading: Does Old Techniques work?

“I fear not the man who has practiced 10,000 kicks once, but I fear the man who has practiced one kick 10,000 times”_ Bruce Lee

In line with the famous martial artist, it can be said that is of no worth if you just beat around the bush for finding new strategies during intraday gap up or gap down trading and don’t practice of your own with simple logics. New retailers in stock market find it very difficult to determine whether a stock trend would be supported by its previous pattern or it would just fail badly.

Gap Trading & Historical Patterns

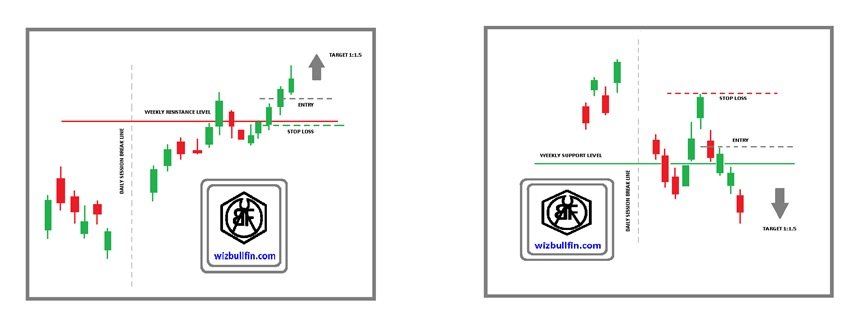

So, here is one trick. Intraday trading can be done very confidently after finding its major supports and resistances in weekly or daily candle stick charts. Use of two time frames gives confidence enough to hold on with strict stop loss in intraday trading.

In stock market, history do repeats. So, historical levels would be helpful during gap up or gap down candle- stick charts.

Do find major support and resistance in weekly or daily candle stick chart as shown above (Chart source: https://in.tradingview.com )

Gap Trading: Gap up or Gap down- How can we beat the game?

| In case market opening on gap-up trend near weekly resistance: Wait for first few 15 minute candles to form In case stock trend breaks the weekly resistance then candle should re- test it’s weekly resistance strength After re-test let there be one firm ( body part of candle should not be negligible) green candle above weekly resistance Now the weekly resistance would act as a support for intraday Our stop loss will be candle’s low prior to the confirmation or entry candle Target will be = (Entry-Stop Loss)X1.15= 1:1.5 | In case market opening on gap-down trend near weekly support: Wait for first few 15 minute candles to form In case stock trend breaks the weekly support then candle should re- test it’s weekly support strength After re-test let there be one firm ( body part of candle should not be negligible) red candle above weekly support Now the weekly support would act as a resistance for intraday Our stop loss will be candle’s high prior to the confirmation or entry candle Target will be = (Stop Loss- Entry)X1.15= 1:1.5 |

Gap Trading: Learn with graphical representation

Gap Trading: How much can I earn?

Well, personally I would never suggest to hold a position in a hope for a gap up or gap down opening tomorrow. It is always said that you should not stand blind folded in front of wild bull. When you think of a gap trading, you must always make maximum benefit after the occurrence of the gap opening of market. If you can trade based on historical data, up to 50% is achievable.

But remember, experience and timeframe of trade is the key. Some stock respects 2 hour timeframe, while some other respects even 30 minute timeframe. So stock wise your entry and risk: reward should be different. It can not be taught but learned on own experiences.

How do you avoid gap trading?

Well, there are so many ways this can be avoided, Normally what I trade after the gap has happened already. The minimum timeframe for BTST trade with a huge gap can earn you up to 50% single day profit if you do it correctly. My suggestion would be track the same in a time frame not less than 2 hour if you want to trade after a gap up or gap down.

What is forex gap trading?

Forex is normally traded based on multiple pairs. So in case a pair is closed on the previous day much high or much low, today during opening of market, the same would be considered as a forex gap down or forex gap up. Almost similar strategy can be applied for all gap tradings.