Through this article we will discuss about future price levels of Ford which the stock might reach till 2050. Before investing in the stock, the basic business and technical aspects should be discussed in detail.

Ford Motor Company has been putting wheels on the globe since 1903. Henry Ford established the business, which has its headquarters in Dearborn, Michigan. Over the course of its 120-year existence, Ford has come through for people in need. Ford factories also produce bombers and incubators in addition to automobiles. Under the Ford brand, the corporation sells automobiles and commercial vehicles, and under the Lincoln brand, it sells luxury vehicles. Additionally, Ford owns 8% of Aston Martin; 32% of China’s Jiangling Motors; and Troller, a Brazilian SUV manufacturer.

Business in which Ford is presently involved:

Ford is presently involved in following main businesses.

- Electric Vehicles (EVs) : Trucks, SUVs, Mustang, F-150, Bronco etc.

- Ford Credit Finance : For financing affordable financing luxury cars.

- Ford Blue : Taking the internal combustion engine into the future

- Changan Ford Automobile Corporation, Ltd.

- AutoAlliance (Thailand) Co., Ltd.

- Ford Smart Mobility, LLC

- Ford Land: Creating workspaces for deepen the human connection

With generations of legacy meeting innovative cutting edge technology, Ford is one of the most trusted vehicle brand in USA and Europe, China.

Table of Contents

Ford Stock Price Prediction 2050: Stocks performance from 2019 to 2023

Ford Stock Price Prediction 2050: Strengths of the organization

(A) Strong Management

- CEO- WILLIAM CLAY FORD JR. : In January 1999, he became the chair of the board of directors, having joined it in 1988.

- CTO- MIKE AMEND: Before, Amend worked in comparable capacities at JCPenney and The Home Depot, contributing to the annual growth of their online businesses by over 20% and 40%, respectively.

- CEO- TED CANNIS : Cannis as a global director of Team Edison, Ford’s dedicated team could develop the award-winning Mustang Mach-E SUV and participated in F-150 Lightning pickup and E-Transit commercial van.

- CFO- JOHN LAWLER : Previously worked for Ford’s long-term enterprise strategy and played key role in delivering critical partnerships, including with VW and Mahindra.

- President & CEO, Ford Credit- MARION HARRIS: Harris worked for outside banks in treasury before joining Ford, and he also advised and counseled Nelson Bunker Hunt.

(B) Ford could achieve yearly net income of $4.3 billion from revenue of $176.1 billion in year 2023. The company thus could reduce the loss incurred in 2022.

(C) Ford declared in the early 2020s that it would invest more than $50 billion in R&D and electrification by 2026. Additionally, the business declared that by 2050, it hoped to have no carbon footprint.

(D) Strong line up of upcoming vehicles : The electrification of a number of its current vehicles, including the Mustang Mach-E, F-150 Lightning, E-Transit, Electric Explorer, Electric Puma, E-Transit Custom, and E-Transit Courier along with their electrical version can prove to be strong pillars of Ford’s business.

(E) F-150 Lightning the legendary pick up, saw a total sales of 4466 units in the second quarter FY 2023, more than doubling from just over 2000 units wrt. FY 2022.

(G) Ford is backed by various institutional investors like Vanguard Group Inc., BlackRock Inc., and State Street Corp which serves as a very strong financial support.

(H) In order to produce lithium-ion and nickel-cobalt manganese batteries domestically, Ford is constructing a battery plant in Michigan.

(I) Additionally, Ford owns 8% of Aston Martin, 32% of China’s Jiangling Motors, and Troller, a Brazilian SUV manufacturer.

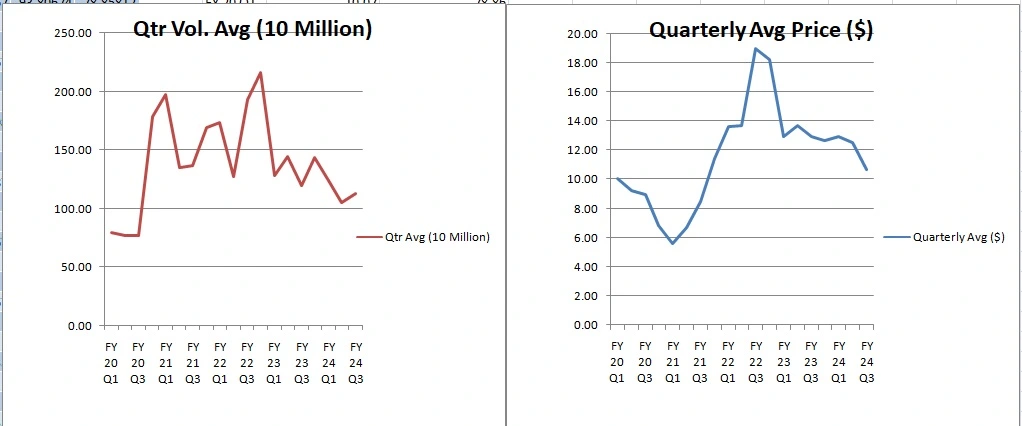

Ford Stock Price Prediction 2050: Historical Performance: 2019 to 2024 March

Ford Stock Price Prediction 2050: Major Challenges

(A) Ford is facing profitability issues with its EV making business. Though company is investing heavily in R&D , Ford might take time to overcome the issue.

(B) With new vehicle companies like TESLA, Mahindra etc. the upcoming days for EV will be full of opportunities with competitions.

(C) For EVs though the carbon footprint is lesser but not zero. The new technologies like Hydrogen Powered cars ,adaptability will be key to success as well as challange.

Ford Stock Price Prediction 2050: Effect of Adversities which might harm the brand

The main challenge which every vehicle company faces today is high production cost due to some extreme import restrictions. One example can be mentioned as of Ford leaving India operation in year 2021.

With rising concern about carbon footprint involved in mining raw materials of battery components , rise in battery raw material costs might make the company face more challenge.

Country first policies like China & India for making more jobs might pull the growth outside US. But at the same pace those countries are not letting adjust the elevated cost of manufacturing. Hence transport cost should be optimized very methodically for long run.

Ford Stock Price Prediction 2050: Key levels

| Year | Average (in $) | High (in $) |

| 2024 | $13.94 | $15.32 |

| 2025 | $14.50 | $16.33 |

| 2026 | $17.55 | $22.25 |

| 2027 | $18.28 | $26.25 |

| 2028 | $19.24 | $26.38 |

| 2029 | $19.88 | $29.09 |

| 2030 | $23.64 | $31.92 |

| 2035 | $24.06 | $32.60 |

| 2040 | $29.96 | $35.43 |

| 2045 | $40.09 | $49.52 |

| 2050 | $50.28 | $65.43 |

Ford Stock Price Prediction 2050: Should I invest in or wait?

As per some experts the US and global economy might soon experience heat of recession. Though all the central banks are getting equipped with appropriate measures, investing in long term should only be done after through analysis of Risk: Reward and sunk cost assumptions. The stock price have the potential to see values more than $100 with reducing expenses of R&D.

What will Ford stock be worth in 2030?

Market can expect a moderate value of approximately $32-35

How much will Ford stock cost in 2025?

Market can expect a moderate value of approximately $17-20

What will Ford stock be in 2024?

With present situation of market, Ford stock value can go up to $16- 17